In the fast-paced world of trading, the stakes can often feel monumental, especially for novices stepping onto the trading floor for the first time. Simulated trading, also known as paper trading, emerges as a crucial sanctuary for these eager learners, offering a risk-free environment to hone their skills.

Imagine navigating the intricate web of financial markets without the fear of losing hard-earned capital—this is where simulated trading comes into play. By replicating real market conditions and enabling users to practice their strategies, it serves as both a training ground and a confidence booster.

Whether you’re curious about day trading, swing trading, or long-term investing, embarking on this journey can transform bewilderment into mastery, one virtual trade at a time. This guide will unravel the mechanics of simulated trading, equipping beginners with the knowledge they need to embark on their trading adventure with clarity and purpose.

How Simulated Trading Platforms Function

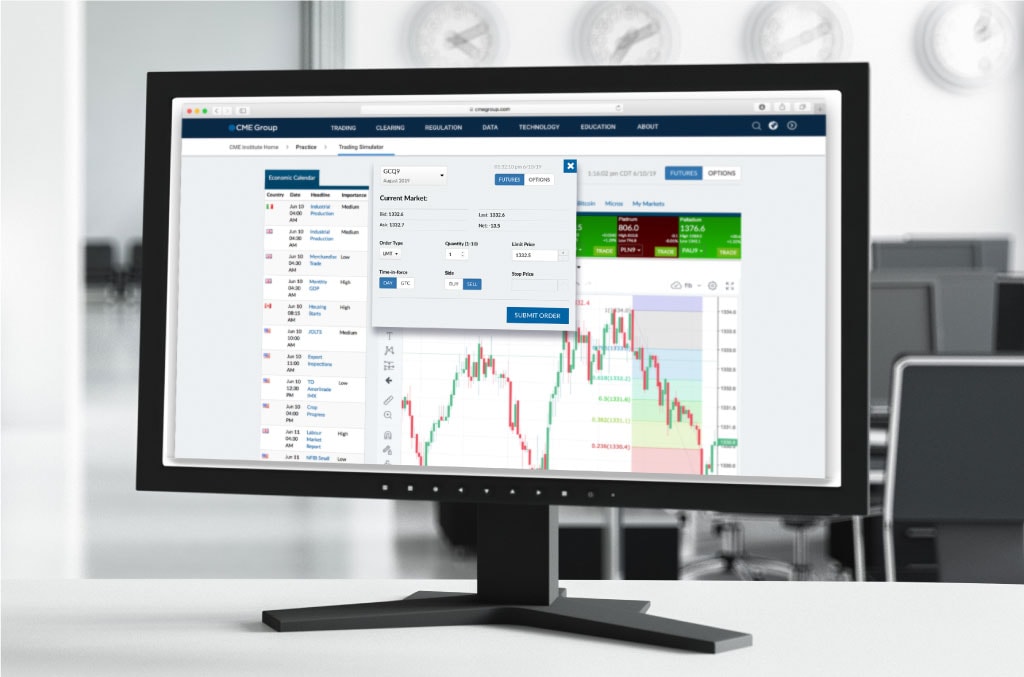

Simulated trading platforms operate as sophisticated ecosystems, designed to mimic real-market conditions without the risk of financial loss. Users are typically given virtual capital—often in substantial amounts—enabling them to execute trades across various asset classes such as stocks, commodities, and currencies.

The platforms integrate real-time data feeds, allowing users to analyze price movements, trends, and market sentiments just like they would in an actual trading environment. Features like free bar replay chart further enhance these platforms by allowing users to replay and analyze historical market data, enabling a more hands-on approach to understanding trading dynamics and refining strategies. Additionally, many of these platforms offer technical analysis tools, risk management options, and opportunities to compete against other traders in simulated tournaments, adding layers of engagement and education.

By providing this rich, interactive experience, simulated trading platforms empower beginners to experiment, learn, and hone their strategies before committing real money to the markets.

Getting Started with Simulated Trading

Getting started with simulated trading can feel like diving into a vast ocean of opportunities, where the thrill of the market awaits without the risk of losing real money. Imagine stepping into the shoes of a professional trader, analyzing stock charts, executing trades, and experimenting with various strategies—all while using virtual currency. To embark on this journey, you’ll first need to select a platform that aligns with your goals, as many offer user-friendly interfaces and a wealth of educational resources.

Once you’ve set up your account, it’s time to familiarize yourself with the tools at your disposal. Experimenting with different stocks, commodities, or currencies can help you discover your trading style and refine your decision-making process.

Don’t forget, this is your chance to make bold moves and learn from your missteps without the stakes that come with real trading—so why not embrace the adventure?

Developing Trading Strategies

Developing trading strategies in a simulated environment offers an exciting playground for both novice and seasoned traders alike. Here, you are free to explore various approaches, from day trading to swing trading, without the looming shadow of financial loss.

Imagine testing the waters with a bold new strategy, refining your entry and exit points based on immediate feedback, all while analyzing market trends and historical data at your fingertips. As you venture deeper, it’s essential to strike a balance—analyzing the effectiveness of each tactic while adapting to the ever-evolving market conditions.

Whether it’s leveraging technical indicators or fundamental analysis, simulated trading allows you to experiment, fail, and learn—all risk-free. The thrill of discovery lies in the process; every simulated trade holds the potential for insight and growth, paving the way for a more robust trading plan when it’s time to step into the real market.

Conclusion

In conclusion, simulated trading offers an invaluable opportunity for beginners to hone their skills and gain confidence without the inherent risks associated with real trading. By utilizing tools such as the free bar replay chart, users can practice trading strategies in a controlled environment, allowing them to analyze market movements and refine their decision-making.

As you embark on your trading journey, remember that simulated trading is not just a practice tool; it’s a stepping stone towards mastering the complexities of the financial markets. Embrace this risk-free practice avenue, and you’ll be well-equipped to transition into live trading with greater knowledge and assurance.