In today’s fast-paced financial landscape, where every tick of the market can resonate through portfolios and reshape investment strategies, understanding the forces that drive market movements is essential. One innovative approach that has gained traction is simulated trading on historical data, a method that allows traders and investors to analyze past market behaviors in a risk-free environment.

By delving into the intricate patterns and anomalies of previous market conditions, individuals can develop a sharper insight into the mechanics of trading. This article explores the invaluable lessons gleaned from simulated trading, shedding light on how historical data can unveil trends, clarify market psychology, and ultimately foster a deeper comprehension of market dynamics.

Join us as we navigate this fascinating intersection of technology, history, and financial acumen, equipping ourselves with the knowledge to thrive amidst the complexities of modern trading.

The Concept of Simulated Trading

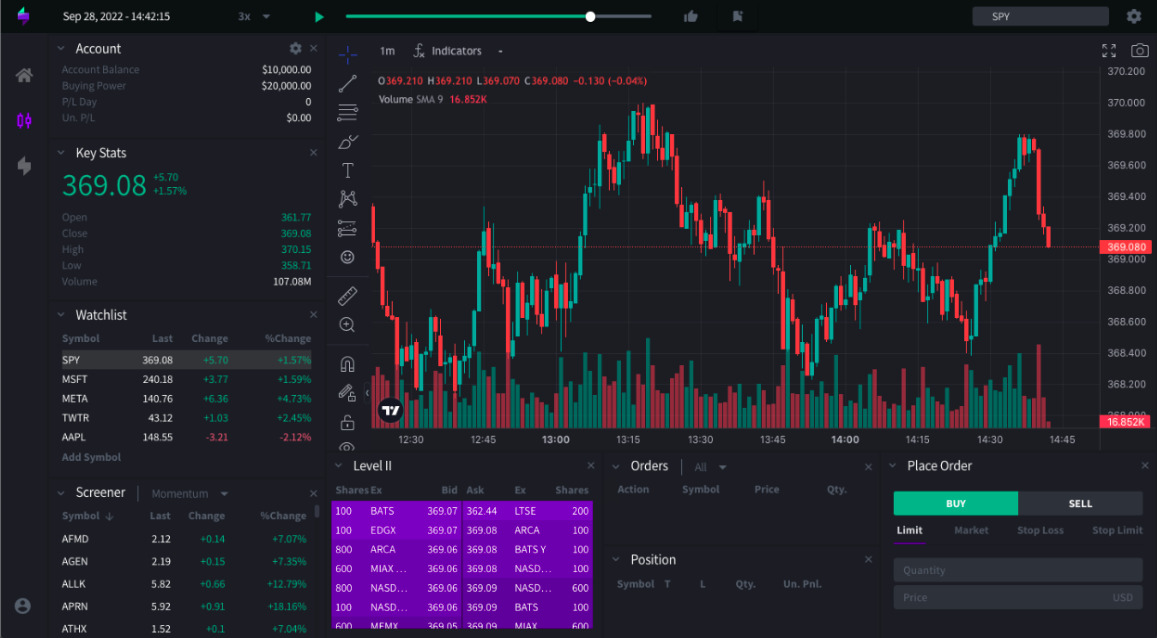

Simulated trading, often heralded as a gateway to mastering financial markets, allows traders to immerse themselves in a risk-free environment where they can experiment with strategies using historical data through free replay chart software. Picture this: a world where every market fluctuation, from the gentlest tick to the most tumultuous surge, serves as a playground for learning.

Here, traders can refine their decision-making skills, sharpen their analytical prowess, and witness firsthand how their strategies perform under varying market conditions. Unlike the high-stakes arena of live trading—which can provoke anxiety and lead to impulsive decisions—simulated trading offers a more composed atmosphere, fostering exploration and innovation.

Yet, the experience is not devoid of challenges; traders must grapple with the nuances of market psychology and data interpretation, ensuring they can pivot and adapt their approaches effectively. Ultimately, it’s this intricate blend of practice and analysis that empowers traders to glean insights and prepare for the unpredictability of real-world investing.

Analyzing Market Trends

Analyzing market trends through simulated trading on historical data offers a comprehensive lens through which investors can discern the nuanced rhythms of financial movements. As one delves into the intricacies of past price fluctuations, patterns begin to emerge, revealing not only the ebbs and flows of markets but also the underlying factors that drive these dynamics.

For instance, a sharp uptick during an economic boom may be contrasted with a sudden downturn amid geopolitical tensions, showcasing how sentiment and external events interplay dramatically. Moreover, the ability to manipulate variables in simulations allows traders to hypothesize about potential future outcomes, fostering a deeper understanding of volatility and market reactions.

Ultimately, this method serves as both a learning tool and a testing ground for strategies, illuminating the path toward more informed investment decisions and fostering a resilient mindset amidst an ever-evolving financial landscape.

Tools and Software for Simulated Trading

In the realm of simulated trading, an impressive array of tools and software awaits traders eager to delve into the intricacies of historical data. Platforms like MetaTrader and TradingView offer intuitive interfaces brimming with advanced charting options, enabling users to visualize market movements with remarkable clarity.

For those seeking a more robust analytical experience, R and Python provide powerful programming capabilities, allowing traders to craft tailored algorithms that can dissect patterns and predict trends. As if that weren’t enough, specialized software like NinjaTrader and Amibroker come equipped with backtesting features, empowering users to test their strategies against past data and fine-tune them with precision.

With this arsenal at their fingertips, traders can embark on a profound journey of exploration, transforming raw historical data into a dynamic playground for honing their skills and understanding market behavior.

Conclusion

In conclusion, understanding market movements through simulated trading on historical data offers invaluable insights for both novice and experienced traders alike. By utilizing techniques such as backtesting and analyzing past market behaviors, traders can refine their strategies and make well-informed decisions in real-time scenarios.

The incorporation of tools like free replay chart software further enhances this learning process, allowing traders to visualize and experience market fluctuations firsthand without risking real capital. As the landscape of financial markets continuously evolves, leveraging historical data through simulation becomes an essential aspect of successful trading practices, ultimately paving the way for more informed and confident investment choices.